How to Choose the 2016 Best Cars: A Step-by-Step Guide for Budget Shoppers

Overview

The article titled “How to Choose the 2016 Best Cars: A Step-by-Step Guide for Budget Shoppers” serves as a valuable resource for budget-conscious consumers seeking affordable and reliable vehicles. It highlights the necessity of establishing a comprehensive budget that encompasses not only the purchase price but also ongoing expenses such as insurance and maintenance. By providing practical tips and strategies for researching and evaluating cars, the article empowers readers to make informed and financially sound decisions.

What are the key elements to consider when budgeting for a car? This guide emphasizes the importance of a thorough approach, ensuring that consumers are well-prepared for the financial commitments associated with vehicle ownership. Ultimately, the article aims to equip budget shoppers with the knowledge needed to navigate their car-buying journey effectively.

Introduction

In a world where the price of new vehicles continues to rise, budget-conscious car shoppers encounter a significant challenge: finding a reliable vehicle without exceeding their financial limits. Navigating the complexities of the automotive market necessitates a strategic approach that transcends mere sticker price considerations.

Understanding total ownership costs, evaluating safety ratings, and exploring financing options are all critical decisions that contribute to long-term affordability and satisfaction. As the market landscape evolves, consumers increasingly seek vehicles that align with their financial constraints while also delivering quality and reliability.

This article explores essential tips, insights, and strategies for making informed choices in the budget car market, empowering shoppers to confidently embark on their automotive journey.

Understanding Budget Shopping in the Car Market

Budget shopping in the car market necessitates a strategic approach that emphasizes value and long-term affordability over luxury. Begin by establishing a clear financial plan that encompasses not only the purchase price but also ongoing costs such as insurance, maintenance, and fuel. This comprehensive perspective ensures you select a mode of transport that aligns with your financial capabilities.

Research models known for their affordability and reliability, paying particular attention to depreciation rates and resale values. Understanding these factors can significantly enhance your investment, enabling you to make informed decisions that benefit your wallet over time.

Tips for Budget Shopping:

- Set a clear budget before you begin your search to avoid overspending.

- Explore options considered the best cars for affordability and reliability in 2016.

- Evaluate total ownership costs, including insurance and maintenance, rather than focusing solely on the initial sticker price.

In 2025, the affordable car market is evolving, with consumers increasingly seeking options that offer both quality and cost-effectiveness. Current statistics reveal that car buyers spend an average of nearly 14 hours online during their search, highlighting the necessity for an optimized shopping experience across all devices. Moreover, a significant portion of consumers—up to 25%—are willing to pay more for a superior buying experience, underscoring the importance of personalized service in the dealership environment.

As noted by Hari Bhushan, “this is the largest price drop since the pandemic, enticing buyers already tired of dealing with the difficulties and expenses of buying new.” This sentiment reflects current market conditions and buyer expectations.

Real-world examples illustrate that many budget-conscious car buyers successfully navigate this landscape by leveraging tools and resources that enhance their shopping experience. For instance, the case study titled “Personalizing the Caller Experience to Boost Conversions” reveals that a majority of car buyers are willing to pay more for a better buying experience; yet, many dealership agents fail to ask for appointments or suggest alternatives when a desired vehicle is unavailable. By utilizing call analytics, dealerships can identify and rectify these issues, potentially converting mishandled calls into sales.

By adopting effective financial planning strategies and utilizing available data, you can confidently assess the total cost of ownership for economical vehicles in 2025, ensuring that your choice not only meets your immediate needs but also supports your financial goals.

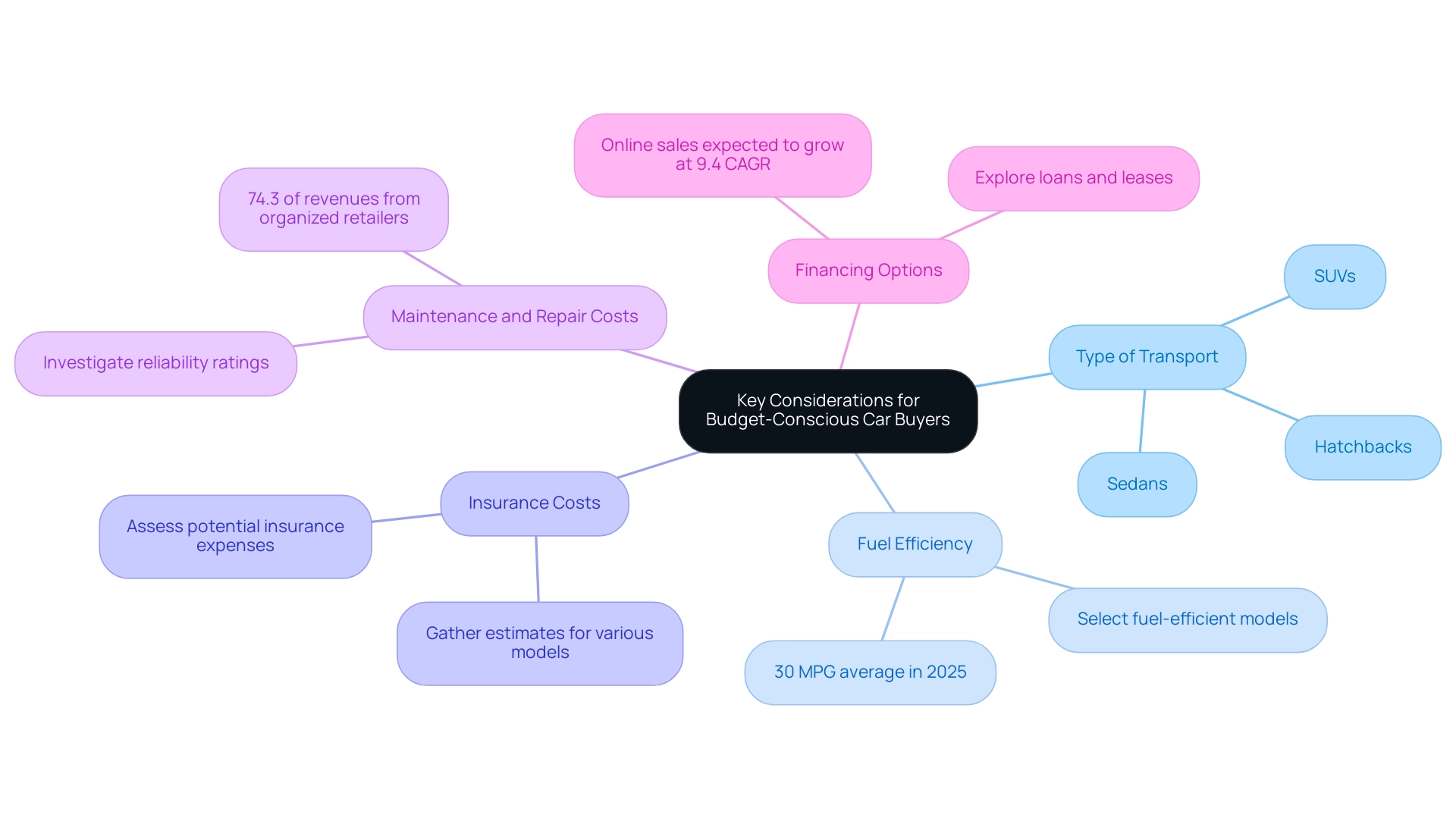

Key Considerations for Budget-Conscious Car Buyers

When navigating the car market on a budget, several critical factors should guide your decision-making process:

- Type of Transport: Evaluate your lifestyle and identify which type of transport best suits your needs. Options include sedans, SUVs, and hatchbacks, each offering distinct advantages in terms of space, comfort, and utility.

- Fuel Efficiency: Prioritize modes of transport that deliver excellent fuel economy. In 2025, the average fuel efficiency for budget-friendly cars is projected to be around 30 miles per gallon, significantly reducing long-term fuel expenses. This statistic highlights the significance of selecting a mode of transport that reduces fuel expenses.

- Insurance Costs: Insurance premiums can vary widely between models. Gather estimates for various automobiles to assess potential insurance expenses, as this can influence your overall budget.

- Maintenance and Repair Costs: Investigate the reliability ratings of potential automobiles. Models known for their durability often incur lower maintenance costs, making them more economical in the long run. For instance, organized retailers dominate the used car market, accounting for 74.3% of revenues, indicating a trend towards reliable, well-maintained vehicles that can save you money on repairs.

- Financing Options: Explore various financing avenues, including loans and leases. Understanding the terms and interest rates available can help you secure the most favorable deal. With online sales expected to increase at a CAGR of 9.4%, there are more resources accessible for shoppers to compare financing options effectively.

Actionable Steps:

- Develop a checklist outlining your specific needs and preferences to streamline your search.

- Utilize online comparison tools to evaluate insurance rates across different models, ensuring you make an informed choice.

- As Derek Andersen notes, “We compiled these stats to help you assess the competition and improve your strategy,” which can be particularly useful when considering your options.

- Consider reviewing case studies that illustrate key considerations for budget car buyers, providing real-world context to the advice given.

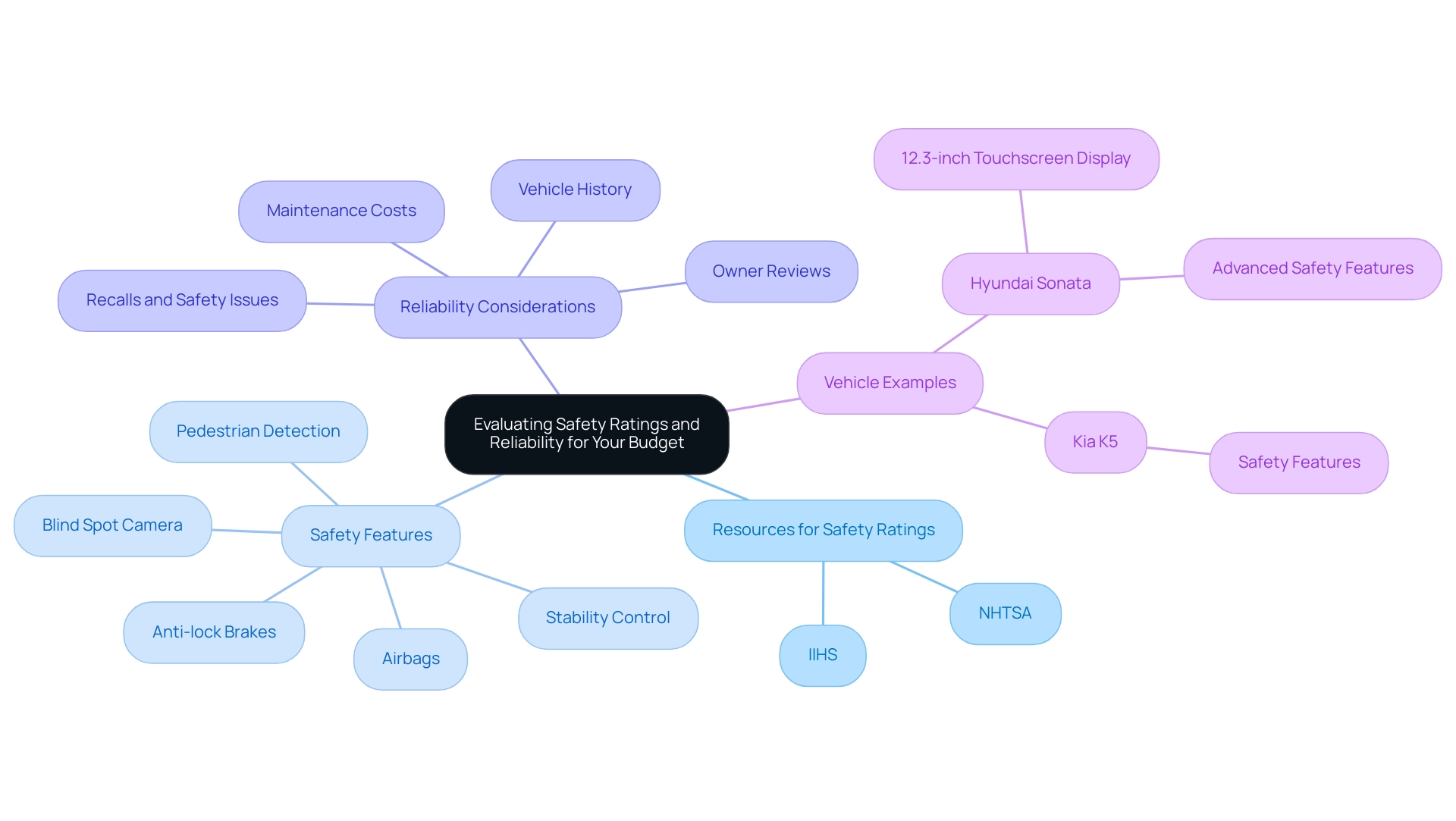

Evaluating Safety Ratings and Reliability for Your Budget

When selecting a budget-friendly car, it is essential to prioritize safety ratings and reliability. Utilize resources such as the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) to verify safety ratings. Concentrate on automobiles that have excelled in crash tests and are equipped with essential safety features, including airbags, anti-lock brakes, and stability control.

For instance, the Hyundai Sonata stands out with advanced safety features like a Blind Spot Camera and Pedestrian Detection. Additionally, it offers a modern 12.3-inch touchscreen display as a standard feature, making it a reliable choice for budget-conscious consumers.

Reliability Considerations:

- Investigate the vehicle’s history and read reviews from other owners to gauge long-term satisfaction.

- Opt for models recognized for their durability and low maintenance costs, which can significantly reduce overall ownership expenses.

- Stay informed about recalls and safety issues associated with specific car models, as this can impact both safety and reliability.

Recent safety ratings emphasize the Hyundai Sonata and Kia K5 as part of the 2016 best cars in the affordable category, praised for their competitive pricing and robust safety features. TrueCar’s rankings highlight these models’ appeal to consumers who prioritize safety without breaking the bank. As Brett T. Evans, an auto writer with over a decade of experience, notes, “Safety ratings are crucial for cost-conscious shoppers to ensure they are making informed decisions that protect their investment and well-being.”

As you evaluate your options, consider real-world examples of budget shoppers who have successfully navigated the safety features of various vehicles. This will ensure that you make informed choices that align with your needs.

Top Affordable Cars of 2016 for Budget Shoppers

For budget-conscious shoppers, the following models are among the 2016 best cars and stand out as excellent choices:

- 2016 Honda Civic: Renowned for its reliability and impressive fuel efficiency, the Honda Civic offers a range of engine options, from a 158-hp base to a 180-hp Sport version. This makes it both fun to drive and economical. It has received high consumer ratings, reflecting its strong performance and dependability.

- 2016 Toyota Corolla: Celebrated for its comfortable ride and low maintenance costs, the Corolla is a practical choice for daily commuting. Its reputation for longevity and reliability is well-documented, appealing to those seeking a dependable vehicle.

- 2016 Ford Fiesta: A compact car that excels in handling and affordability, the Ford Fiesta is perfect for urban driving. Its nimble design and engaging driving experience make it a favorite among cost-conscious shoppers looking for a fun ride without breaking the bank.

- 2016 Hyundai Elantra: With a robust warranty and good resale value, the Elantra is a smart investment. It combines style with practicality, offering a spacious interior and a suite of features that enhance the driving experience.

- 2016 Kia Soul: Known for its distinctive styling, the Kia Soul provides ample space and versatility. Its unique design does not compromise on practicality, making it a popular choice for those who value both aesthetics and functionality.

- Cautionary Note: While considering options, it’s important to be aware of the Nissan Sentra, which has been characterized by underwhelming performance. Featuring a standard 1.8-liter four-cylinder engine that produces 124 hp, this raises concerns about its competitiveness in the small car market compared to the 2016 best cars.

To make the most informed decision, consider the following steps:

- Visit local dealerships to test drive these models and experience their features firsthand.

- Check online reviews and ratings to compare specifications and consumer feedback, ensuring you find the best fit for your needs.

Additionally, Top5.com is committed to providing a user-friendly experience and comprehensive coverage of various categories, helping you navigate your choices effectively. As you consider these options, remember that making informed choices extends beyond just price; it also involves considering the environmental impact and sustainability of your purchase, aligning with the values of ethical consumerism.

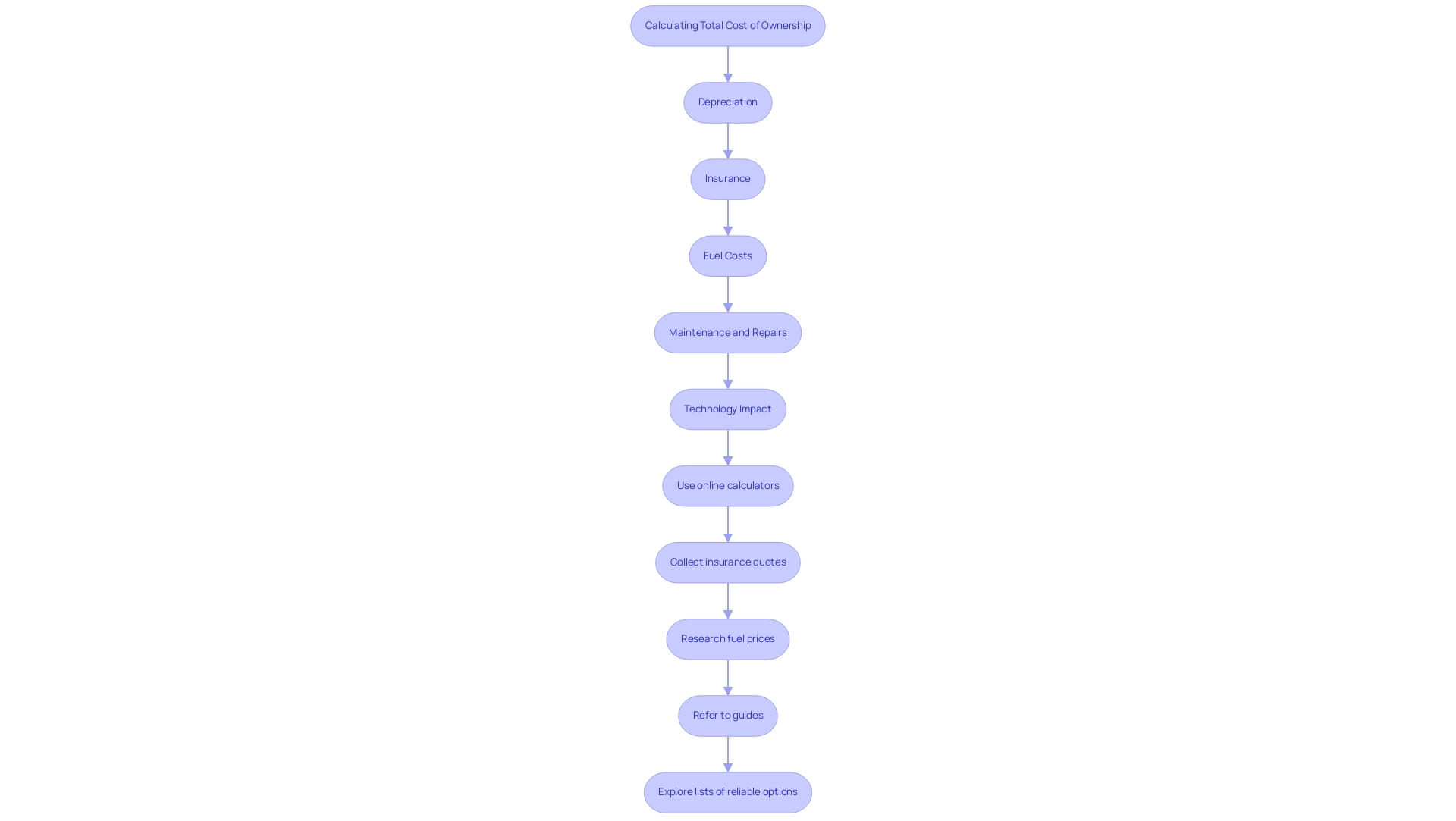

Calculating Total Cost of Ownership: Beyond the Sticker Price

Calculating the total cost of ownership is crucial for budget shoppers, as it encompasses several key factors influencing long-term expenses. Understanding these elements can assist you in making informed choices when selecting an automobile. The primary elements to consider include:

- Depreciation: This refers to the rate at which a vehicle loses value over time. On average, a car can depreciate by approximately 15% of its value each year after the first year. For budget-conscious purchasers, opting for a model with lower depreciation rates can significantly impact total expenses. For instance, Jeep’s average transaction price has dropped by 7.7% year-over-year, indicating a trend worth considering when evaluating your options.

- Insurance: The expense of insuring your vehicle can vary widely based on the make and model. It’s essential to gather quotes for insurance tailored to the specific cars you are considering, as this will contribute to your monthly expenses.

- Fuel Costs: Estimating fuel expenses is vital, particularly in light of fluctuating fuel prices. Research the average fuel prices in your area and consider the fuel efficiency of the car models you are interested in. This will help you estimate your monthly fuel expenses accurately.

- Maintenance and Repairs: Routine maintenance and unexpected repairs can accumulate over time. Examine the typical expenses related to upkeeping the automobiles on your shortlist, as certain models may require more frequent or costly repairs than others. Additionally, consider the significance of technology in vehicle ownership expenses; for example, KBB mentions that the EVs ChaDeMo charger is predominantly outdated, which could impact long-term expenditures for electric vehicle owners.

Steps to Calculate Total Cost:

- Utilize online calculators designed to estimate depreciation and total ownership costs, providing a clearer picture of your potential expenses.

- Collect insurance quotes for the specific models you are considering to understand how much you will need to budget for coverage.

- Research average fuel prices and the fuel efficiency ratings of the vehicles you are evaluating to estimate your fuel expenses accurately.

- Refer to guides such as “How to Buy a Used Car: A Definitive Guide” for practical tips and strategies that can empower you in the used car market.

- Explore lists such as the guide on the 25 best used vehicles under $15,000 to identify reliable options that retain value.

By taking these steps, budget shoppers can effectively calculate the total cost of ownership, ensuring they choose an automobile that aligns with their financial goals while minimizing long-term expenses.

Strategies for Comparing Prices and Finding the Best Deals

To secure the best deals on cars, consider implementing the following strategies:

- Utilize Online Comparison Tools: Leverage platforms such as Kelley Blue Book and Edmunds to compare prices across various dealerships. These tools provide insights into market values and help you identify competitive pricing, which is crucial as car buyers now spend nearly 14 hours online during their search. With the growing trend of online car shopping, the share of car purchases completed online and fulfilled by delivery in the United States was reported in 2022, with forecasts indicating a range of 10% to 15% by 2026.

- Master the Art of Negotiation: Negotiation is key when dealing with car dealerships. Equip yourself with knowledge about the market value of the automobile you’re interested in. This preparation can significantly enhance your bargaining power. Studies indicate that up to 25% of mishandled calls can be converted to sales by following up effectively, highlighting the importance of persistence in negotiations. This quote from Dealer Marketing Magazine reinforces the need for effective follow-up in the car-buying process.

- Choose the Right Timing: Timing your purchase can lead to substantial savings. Shopping during off-peak periods, such as the end of the month or during holiday sales, can enhance your chances of receiving discounts, as dealerships are often eager to meet sales quotas during these times.

- Engage with Online Communities: Joining online forums or groups dedicated to economical shopping can provide valuable insights and shared experiences from fellow consumers. These platforms can be a treasure trove of advice on negotiation tactics and current promotions.

- Monitor Local Advertisements: Keep an eye on local advertisements for special promotions and deals. Many dealerships provide exclusive discounts that might not be widely promoted online.

By utilizing these strategies, cost-conscious shoppers can navigate the complexities of the automotive market more effectively. Notably, the average price of new vehicles has risen from under $35,000 in 2016 to around $47,000 in 2023. This trend underscores the importance of being well-informed and strategic in your car-buying journey, particularly when considering the best cars of 2024 and reliable models from 2014 to 2017.

Financing Your Car: Tips for Budget Shoppers

When financing your car, consider the following strategies to maximize your finances:

- Get Pre-Approved: Securing pre-approval for a loan before visiting dealerships is crucial. This not only clarifies your budget but also enhances your negotiating power with sellers. Pre-approval rates significantly influence the financing process, allowing buyers to approach negotiations with confidence.

- Shop Around: It’s essential to compare loan offers from various sources, including banks, credit unions, and dealerships. This practice can lead to discovering the best interest rates available. Current average interest rates for car loans in 2025 are competitive, but they vary widely based on the lender and the borrower’s credit profile. Notably, higher interest rates do not appear to explain the higher monthly payments for borrowers, indicating that other factors may be at play.

- Consider Loan Terms: While shorter loan terms may result in higher monthly payments, they can ultimately save you money on interest over the life of the loan. This is particularly important as auto loan delinquency rates have risen, with many borrowers struggling to keep up with payments due to increased loan balances and interest rates. In fact, statistics indicate that auto loan delinquency rates have exceeded pre-pandemic levels, emphasizing the necessity for careful budgeting.

- Look for Special Offers: Many manufacturers provide special financing deals that can reduce your overall expenses. These promotions can be particularly beneficial for budget-conscious buyers.

- Be Cautious of Add-Ons: Additional features or services offered at the dealership can inflate the total cost of your loan. It’s important to evaluate these add-ons critically to avoid unnecessary expenses.

- Understand Down Payments: According to Edmunds, drivers put down on average $6,619 for new (16 percent) and $4,165 for used vehicles (15 percent) in the third quarter of 2024. Understanding what to expect for down payments can assist you in planning your finances more effectively.

By following these tips, cost-conscious shoppers can navigate the car financing landscape more effectively, ensuring they secure the best possible deal while managing their financial health.

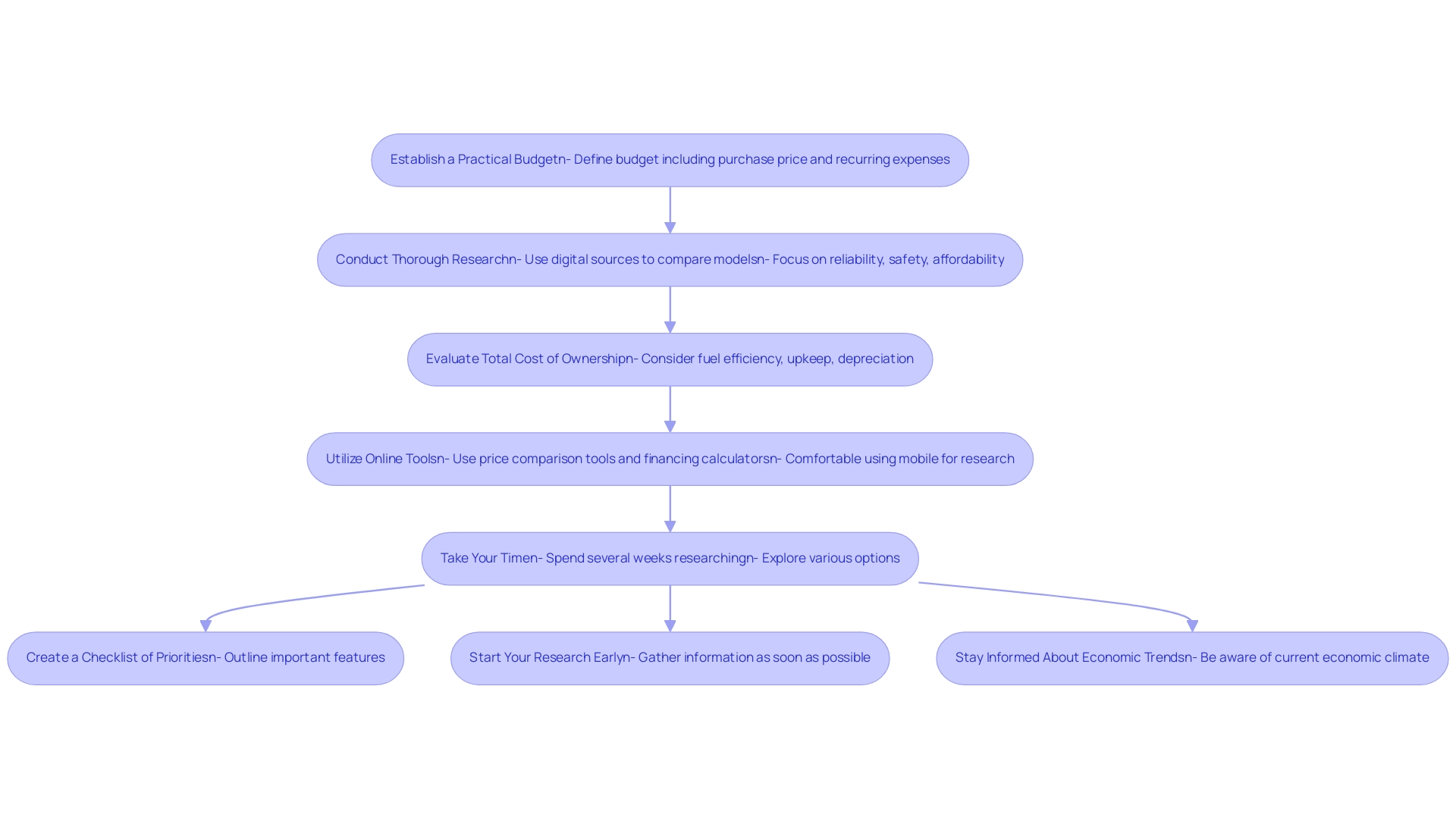

Final Tips for Choosing the Best Car on a Budget

To effectively select the finest vehicle within a budget, consider these crucial steps:

Establish a Practical Budget: Begin by defining a budget that encompasses not just the purchase price but also recurring expenses such as insurance, maintenance, fuel, and potential financing charges. This comprehensive approach ensures you are financially prepared for the long term.

Conduct Thorough Research: With 95% of vehicle buyers relying on digital sources for information, leveraging online tools to compare different models is essential. Focus on factors such as reliability, safety ratings, and affordability. Websites that aggregate reviews and ratings can be particularly beneficial in this process. Remember, the average consumer invests several weeks in researching before making a decision, so take your time to gather as much information as possible.

Evaluate Total Cost of Ownership: Look beyond the initial purchase price. Consider factors like fuel efficiency, upkeep expenses, and depreciation rates. Understanding the total cost of ownership will assist you in making a more informed decision that aligns with your budget.

Utilize Online Tools: Take advantage of online price comparison tools and financing calculators. These resources can help you identify the best deals available and understand your financing options, making the buying process more transparent. Additionally, with nearly 23% of respondents making their car purchase through a mobile phone, ensure that you are comfortable using your smartphone for price comparisons and research.

Take Your Time: Avoid rushing into a purchase. The average consumer spends significant time—often several weeks—researching before making a decision. Use this time wisely to explore various options and ensure you find the best deal that meets your needs.

Action Plan:

- Create a Checklist of Priorities: Outline the features that are most important to you, such as fuel efficiency, safety features, or technology options. This checklist will guide your research and help you stay focused.

- Start Your Research Early: Begin gathering information as soon as possible. The more data you collect, the better equipped you will be to make a confident decision when the time comes to purchase your vehicle.

- Stay Informed About Economic Trends: Be aware of the current economic climate and mixed consumer sentiment, as these factors may influence your budget and spending intentions.

Conclusion

Budget-conscious car shoppers encounter a challenging landscape; however, with the right strategies, securing a reliable and affordable vehicle is entirely achievable. The journey commences with a clear understanding of total ownership costs, which encompass not only the sticker price but also insurance, maintenance, and fuel expenses. By prioritizing vehicles recognized for their reliability and low depreciation rates, shoppers can make informed choices that benefit their long-term financial health.

Key considerations, including vehicle type, fuel efficiency, and financing options, play crucial roles in the decision-making process. Emphasizing safety ratings and reliability ensures that budget shoppers invest in vehicles that not only meet their needs but also provide peace of mind. This article highlights various practical steps, from utilizing online comparison tools to engaging with local dealerships, all designed to enhance the car-buying experience.

Ultimately, the goal of budget shopping in the automotive market is to strike a balance between affordability and quality. By dedicating time to research, evaluating total ownership costs, and leveraging available resources, consumers can confidently navigate the complexities of the car market. With careful planning and informed decision-making, budget-conscious buyers can secure vehicles that align with their financial goals and lifestyle needs, paving the way for a satisfying and economical automotive journey.

Frequently Asked Questions

What is the first step to budget shopping in the car market?

The first step is to establish a clear financial plan that includes not only the purchase price but also ongoing costs such as insurance, maintenance, and fuel.

Why is it important to research car models before buying?

Researching car models helps identify those known for affordability and reliability, and understanding depreciation rates and resale values can significantly enhance your investment.

What are some tips for effective budget shopping?

Tips include setting a clear budget to avoid overspending, exploring affordable and reliable car options, and evaluating total ownership costs rather than just the initial price.

How much time do car buyers typically spend researching online?

Car buyers spend an average of nearly 14 hours online during their search for a vehicle.

What percentage of consumers are willing to pay more for a superior buying experience?

Up to 25% of consumers are willing to pay more for a superior buying experience.

What are some critical factors to consider when navigating the car market on a budget?

Key factors include the type of transport needed, fuel efficiency, insurance costs, maintenance and repair costs, and financing options.

What is the projected average fuel efficiency for budget-friendly cars in 2025?

The projected average fuel efficiency for budget-friendly cars in 2025 is around 30 miles per gallon.

How can insurance costs affect a budget when buying a car?

Insurance premiums can vary widely between models, so gathering estimates for various automobiles is essential to assess potential insurance expenses that can influence your overall budget.

What should you investigate regarding maintenance and repair costs?

It’s important to investigate the reliability ratings of potential automobiles, as models known for their durability often incur lower maintenance costs.

What are some actionable steps to streamline the car buying process?

Actionable steps include developing a checklist of specific needs, using online comparison tools for insurance rates, and reviewing case studies that illustrate key considerations for budget car buyers.